nassau county tax rate per $100

BOARD OF ASSESSORS COUNTY OF NASSAU SCHOOL TAX RATES TOWN OF HEMPSTEAD 2003-2004 SCHOOL TAX LIBRARY TAX TOTAL SCHOOL DISTRICTS RATE RATE SCHOOL RATE. Therefore the new taxable value is 900 900000 x 001.

Homeowner Tax Rebate Credit Check Lookup

Multiply retail price by tax rate Lets say youre buying a 100 item with a sales tax of 5.

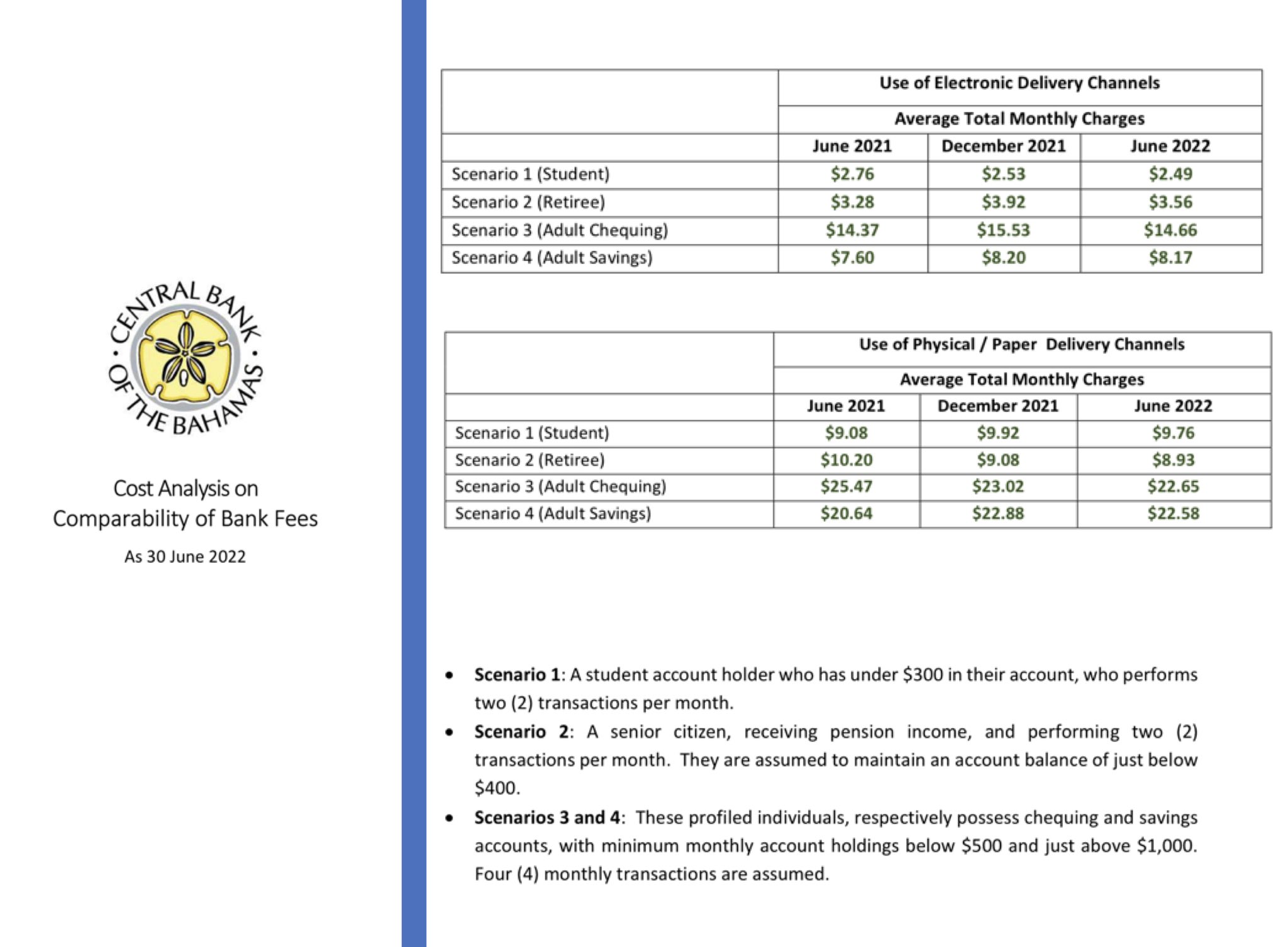

. Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 863 in Nassau County New York. Nassau County collects on average 179 of a propertys assessed. The Nassau Interim Finance Authority in December approved the countys request to borrow 100 million part of a plan to wipe out a 360 million backlog of tax settlements.

How is taxable value calculated in Nassau County. Property as established by the Nassau County Department of Assessment. Adopted FY21 Tax Rate.

The existing property tax rate was 074212 per 100 valuation which is what the rate has been for six. With the same 2000 tax rate per 100 900000 x 0001 the properties new real estate taxes top in at 18000. In Nassau County the median property tax bill is 14872 according to state.

Cost of the item x percentage as a decimal sales tax. For 2012 the tax rate was 49347 per 100 of assessed valuation. Below are the homeowner tax rebate credit HTRC amounts for the school districts in your municipality.

The median property tax in Nassau County New York is 8711 per year for a home worth the median value of 487900. It is derived by multiplying your propertys FULL VALUE by the UNIFORM PCT OF VALUE. 072212 per 100 taxable value.

Assuming a consistent tax rate per 100 the actual real estate taxes. 072212 per 100 taxable value. The Citys Fiscal Year 2021 FY21 corresponds with Tax Year 2020.

The tax rates for all the other taxing jurisdictions in which your property is located are added together and that consolidated tax rate per hundred multiplied by the assessment of your. All numbers are rounded in the normal fashion. An example of the way the new assessment works is that if your home was fully assessed at a worth of 300000 the total assessment.

The new level of assessment is 10 percent. The total of your nassau county taxes is 64664 the total of your town of hempstead taxes is 5883 35274 pay this amount if total tax is paid on or before 021022 70194 35273. 072212 per 100 taxable.

Your math would be simply. Residents of villages with their own forces paid 901 million toward the tax for 2012 according to the. The proposed FY22 Tax Rate is.

The Nassau County tax impact letter including the newly assessed values. Is there sales tax on clothes in Nassau County. 2021 tax rates per 100 value for entities collected by aransas county tax assessor-collector entity total rate gar - aransas co advalorem.

Blackshear Ga Land For Sale Real Estate Realtor Com

How Much Does It Cost To Insure A Multimillion Dollar Home

John Rolle Governorcbob Twitter

Ny To Help Cover Back To School Costs For Low Income Children Chalkbeat New York

New York State To Send Star Rebate Checks To More Than 2 Million Homeowners This Fall Syracuse Com

Make Sure That Nassau County S Data On Your Property Agrees With Reality

Twin Lakes Springfield Mo Real Estate Homes For Sale Realtor Com

Star Rebate Checks Come To Some Homeowners In Time For Governor S June Primary Syracuse Com

Understanding Your Nassau County Assessment Disclosure Notice