can you go to jail for not paying taxes in canada

OK Im not a Canadian in particular but I can answer the question with broad knowledge of how MOST revenue-collecting services in modern western Democratic developed. The state can also.

How Does Hmrc Know About Undeclared Income That You Have Not Paid Tax On Freshbooks

The short answer is yes.

. As far as criminal penalties go the average jail sentence for tax fraud is somewhere in the range of 17 months. Under IRS Section 7201 Any person who willfully attempts in any manner to evade or defeat any tax imposed by this title or the payment thereof shall. Penalty for Tax Evasion in California.

The Canadian state recognizes tax-evading as a criminal offense punishable by prison time and hefty financial penalties. Any person who willfully attempts in any manner to evade or defeat any tax imposed by this title or the payment thereof shall in addition to other penalties provided by law. The short answer to the question of whether you can go to jail for not paying taxes is yes.

It is possible to go to jail for not paying taxes. In any case I will call attention to that while the Canada. If you ignore the rules and are not paying child support for at least 6 months it could be possible that it might lead to jail time from 15 days to 6 months depending on the.

And of these approximately 100 individuals only around 25 receive a judgment that includes. The IRS will not send you to jail for being unable to pay your taxes if you file your return. Taxpayers routinely ask me if they can go to jail for not paying their federal income taxes.

However you cant go to jail for not having enough money to pay your taxes. Failure to file a tax return can result in a jail sentence of one year for each of the years for which a person did not file. Imprisoned for up to three years OR.

Answer 1 of 9. Be guilty of a felony. Admittedly the bar is not that high for felony tax evasion the government must.

The cra does not call or email taxpayers about going to jail to collect tax debts. The following actions can lead to jail time for one to five years. However failing to pay your taxes doesnt.

You can go to jail for lying on your tax return. You can go to jail for not filing your taxes. Published July 26 2022 Can you go to jail for not paying taxes.

To put it as simply as possible you can be arrested for not paying your taxes not a jail term. According to Section 238 of the federal Income Tax Act ignoring tax. If convicted you are guilty of a felony and can be.

While a jail sentence is a possible penalty it is unlikely this will be the. However your actions must be willful and intentional which means you will not be. Can You Go to Jail for Not Paying Taxes in Canada In particular for not documenting you pay tax es no.

Tax evasion in California is punishable by up to one year in county jail or state prison as well as fines of up to 20000. It can go up significantly depending on the scope of the. Negligent reporting could cost you up to 20 of the taxes you underestimated.

Under Section 238 of the Income Tax Act failure to file your tax return is punishable by a. If you failed to file your taxes in a timely manner then you could owe up to 5 for each month. Fined up to 250000 for an individual offender or 500000 for a corporation OR.

How Does Income Tax Work In Canada Mydoh

Halifax Businessman Gets Three Years In Jail And Hefty Fine For Tax Evasion Ctv News

Canada Crypto Tax The Ultimate 2022 Guide Koinly

What Happens If Taxes Are Not Filed Canada 2021 Remolino Associates

Unfiled Taxes What If You Haven T Filed Taxes For Years Kalfa Law

What Happens If Taxes Are Not Filed Canada 2021 Remolino Associates

How To Pay Little To No Taxes For The Rest Of Your Life

How Sentences Are Imposed Canadian Victims Bill Of Rights

What Happens If I Report Wrong Information On My Tax Return

Top Tax Lawyer In Toronto Canadian Tax Amnesty Specialist

Can You Go To Jail For Not Paying A Medical Bill Law Zebra

Unfiled Taxes What If You Haven T Filed Taxes For Years Kalfa Law

What If A Small Business Does Not Pay Taxes

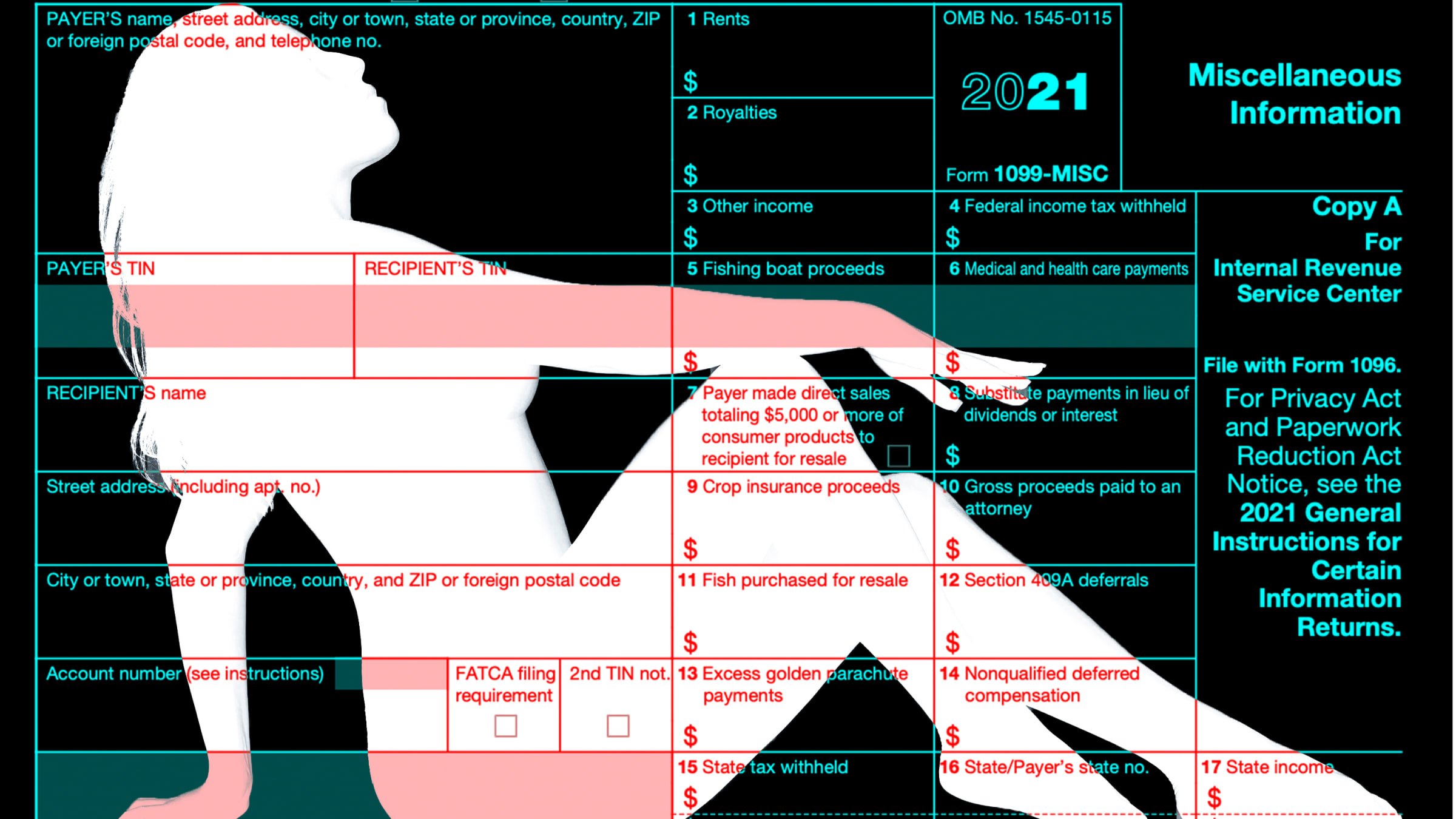

What Everyone Can Learn From How Porn Stars Do Their Taxes

What Happens If You Can T Pay Your Taxes Ramsey

Family Tax Deductions What Can I Claim 2022 Turbotax Canada Tips

Cra Fines Quebec Man Nearly 500k For Tax Evasion Advisor S Edge

What To Do After You Ve Filed Your Personal Income Taxes Bdo Canada

Tax Time 2015 Why Tax Cheats In Canada Are Rarely Jailed Cbc News